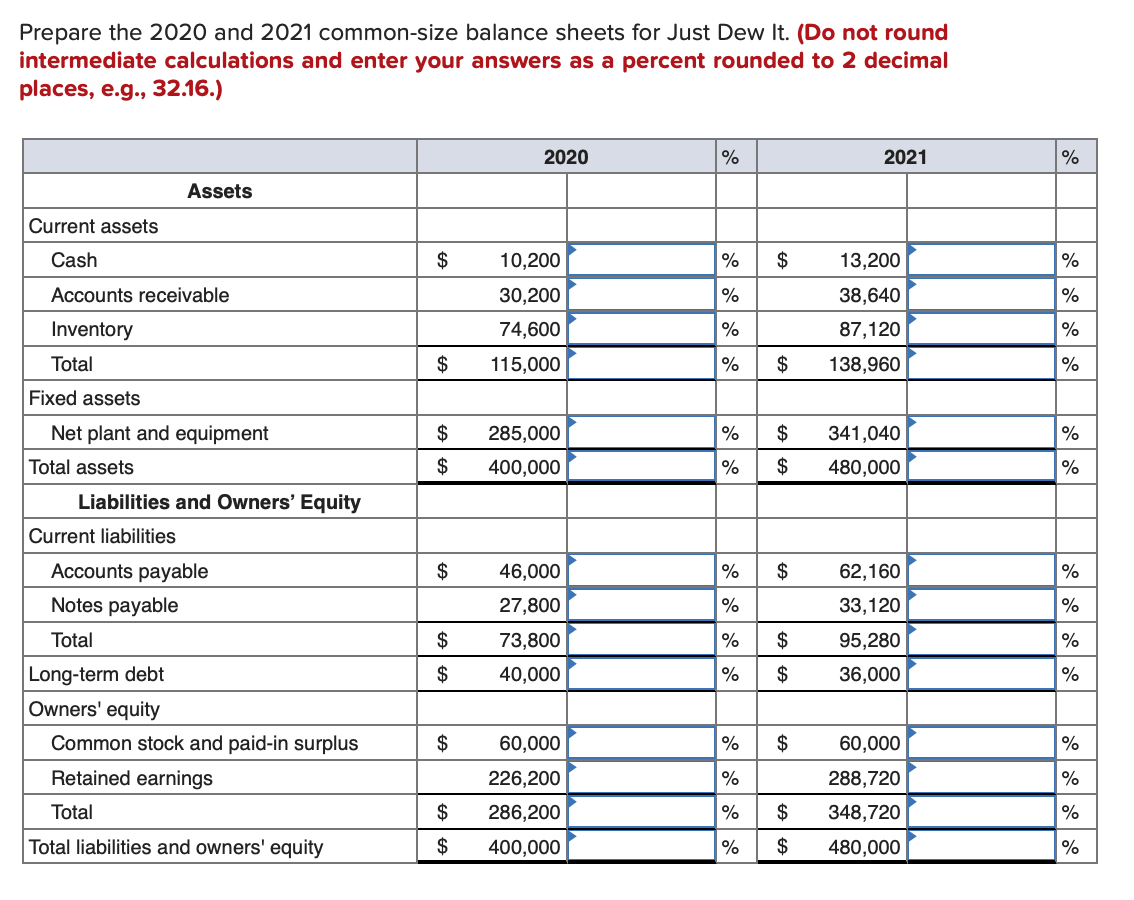

How To Prepare Common Size Balance Sheet - Analysts are generally most interested in ratios that measure liquidity. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals. You can also look to determine an optimal capital. Here we discuss common size balance sheet format and examples of apple and colgate. Web this article has been a guide to common size balance sheet analysis. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. You may learn more about from the following. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web the common size balance sheet formula takes a line item divided by the base amount times 100 for a given period. For the balance sheet, line items are typically divided by total assets.

You can also look to determine an optimal capital. Web the balance sheet common size analysis mostly uses the total assets value as the base value. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web this article has been a guide to common size balance sheet analysis. Analysts are generally most interested in ratios that measure liquidity. For the balance sheet, line items are typically divided by total assets. Web to common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. Here we discuss common size balance sheet format and examples of apple and colgate. You may learn more about from the following. Web the common size balance sheet formula takes a line item divided by the base amount times 100 for a given period. Web the common size strategy from a balance sheet perspective lends insight into a firm’s capital structure and how it compares to its rivals.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)